| UGB394 International Financial Reporting |

Question 1

Tangled Plc. is a wholesale distributor of advanced security solutions for large industrial complexes. The company is considering expanding its business and comparing between two potential opportunities for investment in either Rapunzel Ltd or Flynn Secure Ltd. You as Finance Director of Tangled Plc. have asked your assistant to prepare a report that summarises the financial aspects of the two potential investees for the last year. Your assistant has presented a number of financial ratios that can assist in the identification and interpretation of trends for each. The following ratios have been calculated for the year ended 31st December 2024 for each company:

| Ratio | Rapunzel Ltd | Flynn Secure Ltd |

|---|---|---|

| Current ratio | 1.1 | 4.0 |

| Acid-test ratio | 0.80 | 1.0 |

| Accounts receivable days | 50 | 30 |

| Inventory turnover (times) | 6.0 | 12.80 |

| Accounts payable days | 75 | 30 |

| Percent of total debt to total assets | 40% | 80% |

| Gross profit percentage | 24.6% | 12.5% |

| Operating profit percentage | 10% | 5% |

| Return on capital employed | 16% | 4% |

| Gearing | 20% | 75% |

| Interest cover (times) | 2 | 5 |

| Dividends in pence | 7.20 | 1.20 |

Required:

Prepare a Power Point presentation to the Board of Directors of Tangled Plc. that analyses the performance of Rapunzel Ltd and Flynn Secure Ltd and provide recommendations as to which of the two investment options offers a better opportunity. Your presentation should include comments on:

- performance areas which the data allows.

- comments upon any additional information you consider should be obtained prior to a final decision being made.

Your presentation must be NO MORE than 12 content slides with 2 additional slides: one for welcome and one for any additional questions. Each slide must be copied into Microsoft Word and your verbal presentation you would make must be written In Microsoft Word after each slide. Please note that you will NOT be asked to present the presentation slides, however, you MUST show your speech in your Microsoft Word answer after each slide only. (Word Count 1,800)

Total 50 marks

Question # 1 Guide:

In your answer you should:

- Demonstrate a clear understanding of key financial ratios and calculations relevant to assessing a potential takeover target.

- Interpret the ratios in the context of the takeover decision, explaining how they reflect the financial health of the target.

- Analyze the interrelationships between different ratios, highlighting how they complement or contradict each other.

Question Background:

Week 6 & 7 (Lecture) and Week 6 & 7 (Seminar), Ratios and Interpretation of Accounts, UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Mourik/Kirwan, A. (2023) International Financial Reporting and Analysis. Chapter 27 & 28. 9th edition. Cengage Learning.

Question 2

Quantum Systems Ltd. is the European distributor of specialised AI-powered medical diagnostic equipment. The Finance Director has asked you to prepare accounts for the year ended 30 April 2025, ready for publication on Monday. You have obtained the following trial balance from the computerised accounts:

| 000’s | 000’s |

|---|---|

| Sales | 17,000 |

| Provision for depreciation | |

| Fixtures | 300 |

| Vehicles | 200 |

| Rent receivable | 400 |

| Trade payables | 260 |

| Debentures | 2,000 |

| Issued share capital – ordinary shares | 300 |

| Issued share capital – preference shares | 100 |

| Share premium | 20 |

| Retained earnings | 1,900 |

| Inventory | 200 |

| Purchases | 9,500 |

| Salesmen’s salaries | 300 |

| Administrative wages and salaries | 350 |

| Land | 4,000 |

| Fixtures | 1,500 |

| Motor vehicles | 1,200 |

| Goodwill | 1,500 |

| Distribution costs | 230 |

| Administrative expenses | 300 |

| Directors’ remuneration | 2,000 |

| Trade receivables | 250 |

| Cash at bank and in hand | 1,150 |

| 22,480 | |

| 22,480 |

Note all figures are in 000’s.

The following information was not taken into the trial balance data:

- Audit fee of 20,000

- Depreciation of fixtures at 10% straight-line

- Depreciation of vehicles at 25% reducing balance

- The goodwill suffered an impairment in the year of 550,000.

- Income tax 150,000.

- Debenture interest was 10% and has yet to be paid.

- Closing inventory was valued at 100,000 at the lower of cost and net realisable value.

- Land was to be re-valued by upwards 450,000.

For information:

There were no new vehicles were bought during the year. One vehicle costing £10,000 and with depreciation to date of £5,000 was sold. This transaction was completed and is in the above figures. There were no other disposals.

Required:

Produce for publication:

- Statement of Profit or Loss (Income Statement) (10 marks)

- Notes for Statement of Profit or Loss (Income Statement) (5 marks)

- Statement of Financial Position (14 marks)

- Notes for Statement of Financial Position (3 marks)

Total: 32 marks

Question # 2 Guide:

In your answer you should:

- Prepare accurate financial statements – Demonstrate your ability to compile the Statement of Profit or Loss and Statement of Financial Position, including all necessary adjustments.

- Apply accounting principles: Focus on adjustments such as depreciation (fixtures and vehicles), goodwill impairment, inventory valuation, land revaluation, and accrued debenture interest etc. Ensure that these are correctly reflected in the financial statements.

- Provide detailed notes to financial statements: Explain / show the key adjustments made, including the treatment of audit fees, tax provisions, and any revaluation or impairment of assets etc., ensuring clarity and compliance with accounting standards.

Question Background:

Week 1-3 (Lecture) and Week 1-3 (Seminar), Financial Statements Presentation, UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Week 5 – 10 (Lecture) and Week 5 – 10 (Seminar), Non-Current Assets, Intangible Assets, Inventories & Provisions, Contingent Assets & Liabilities UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Mourik/Kirwan, A. (2023) International Financial Reporting and Analysis, 9th edition. Cengage Learning:

- Chapter 7 – for Presentation and Disclosure in Published Financial Statements

- Part 2 – for Individual Elements of Financial Statements

Question 3

This question is in 2 parts A) and B) and all must be answered to gain full marks. After graduating, you secure a position at a small accounting firm. A key part of your role involves guiding customers through less common issues, helping them make informed decisions when they are unsure of how to proceed. Over the past week, you received the following calls from clients seeking your expertise and advice.

A) Your biggest client, who is VAT registered, had decided to expand their operations and have bought a new state-of-the-art machine for improved productivity on their production line. The machine started production on 1st July. You have identified costs as follows:

You will need to write a report (approx. 750 words) to the client stating in each line:

- The cost of each line to be added and total cost of the machine. (6 marks)

- Explain each line as to why you have included or excluded the cost. (6 marks)

| Basic costs | 300,000 |

|---|---|

| Manufacturers Discount | 120,000 |

| VAT tax | 80,000 |

| Import duties (non-recoverable) | 50,000 |

| Employment costs construction staff for 3 months to 31st July | 30,000 |

| Other overheads – costs and delays when there was a power cut for 3 days | 20,000 |

| Current dismantling costs estimated in 5 years’ time. | 25,000 |

| External Advisors related to construction costs | 12,000 |

B) Espresso Plc was incorporated in 1998 in Singapore and has grown into a national brand in the coffee roasting business. They now have several large contracts with globally recognised hotel and leisure businesses. This growth has however been at reduced margins to enable successful bids for the contacts. Espresso Plc has been researching a new technique to cut down the time for producing their main product, the “Golden Tropic Roast.” They have sent the following to you via e mail.

Dear Accountant

We are looking to gain advice in the strictest of confidence. As you know we have been developing a new technique for roasting of beans. This has been under research now for 3 years and all costs during the first 2 years as per your advice were written off.

However, this year we have spent a considerable amount of additional funds and we need to know if again this cost must be written off. We are concerned that this will result in a loss in our Statement of Profit or Loss and may send the wrong signals to our shareholder and potential investors.

We estimate that the new technique will take 2 more years to develop but to date we feel that we can continue on with the project and that we will be successful in the endeavour. It has been estimated that the process will increase output of beans by 25% and that there will be no increase in other costs for the process except for needing increased amounts of beans for the increased productivity.

Development work has commenced and we are committed that this will continue so long as the project looks viable. There are no definite certain outcomes as yet but independent experts are hopeful for success of this project. The investment this year was £2,800 000. It is estimated we will need another £1,000,000 to continue the development and bring this to a market. We intend to use the system exclusively and start operating the new process as soon as possible.

If you require further information, please contact me.

Mr Mocha

Espresso Plc has requested guidance on whether their recent development costs should be capitalized or expensed under IAS 38. Write a concise email (maximum 450 words) to Mr. Mocha, explaining the key criteria for capitalization under IAS 38. Use the information provided to assess whether the £2,800,000 investment should be treated as an expense or capitalized. Your response should be clear, professional, and well-structured.

Please reference your written answers. (6 marks)

Question # 3 Guide:

In your answer you should:

a) Report on machine purchase:

- Calculate costs: Determine the total cost of the machine, considering relevant expenses.

- Justify treatment: Explain why each cost is capitalized or not, based on accounting principles.

- Presentation: Present your findings in a report format (approx. 750 words) with clear cost breakdowns and justifications.

b) Intangible Assets:

- Summarize IAS 38 Criteria: Outline the key conditions for capitalizing development costs.

- Apply criteria to Espresso Plc: Assess whether the £2,800,000 investment meets these criteria.

- Consider how the asset will generate future economic benefits and if reliable measurement of development costs is possible.

- Concise Professional Response: Draft a structured email (max. 450 words) to Mr. Mocha, explaining your conclusion clearly and professionally.

- Ensure your email is written in correct format (To/From/Subject/Date) and includes a proper greeting (“Dear Mr. Mocha”) and sign-off (“Kind regards, [Your Name]”).

Please reference your written answers.

Question Background:

Week 5 – 7 (Lecture) and Week 5 – 7 (Seminar), Non-Current Assets, Intangible Assets, UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Mourik/Kirwan, A. (2023) International Financial Reporting and Analysis. Chapter 9 & 10. 9th edition. Cengage Learning.

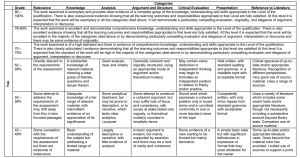

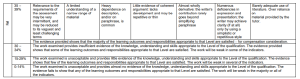

Marking Criteria:

Undergraduate Assessment Criteria

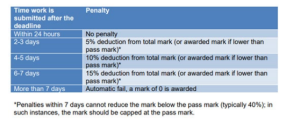

Marking Process: Late Work Penalties and Extensions

Late Work Penalties

Extensions

An extension is where a student may apply, normally via university email, for an extension to the deadline for a piece of work of up to one calendar week from the deadline. The Module Leader, or nominated representative, has the authority to grant an extension on any and all summative assessment points on a module. In the absence of the Module Leader or nominated representative, the Programme Leader has the authority to grant extensions. Students should only refer to the Programme Leader in the absences of the Module Leader or nominated representative. Module Leaders, or their nominated representatives, can grant up to one calendar week extension from the summative deadline on any summative assignment