BAFI1026: Derivatives and Risk Management-A3 Sem 1 2025

| Category | Assignment | Subject | Management |

|---|---|---|---|

| University | RMIT University | Module Title | BAFI1026: Derivatives and Risk Management |

BAFI1026 Assessment Task

This is an individual task. In this assessment, students are required to form one equity portfolio, evaluate their risks and provide solutions to manage the risk. The goal of this individual assignment is to gain a better understanding of the portfolio investment (in the US stock market) and risk management process.

Below are the tasks:

● to build one equity investment portfolio and justify stock selection

● to hold the portfolio from Monday, 12 May 2025 (beginning of Week 10) to Friday, 23 May 2025 and observe its value changes

● to identify the portfolio risk by reporting portfolio’s VaR

● to provide suggestions for managing the risk

● to communicate your investment and risk management process using a professional report

BAFI1026 Portfolio Creation

Please follow the following steps to build one portfolio.

1. Create an account (with your real first & surname) on Market

2. Create a watchlist of one Portfolio based on the close price as of Monday, 12 May 2025

3. This watchlist of Portfolio ($1 million) consists of Four stocks from the S&P500

- Choose any Three stocks from Table 1 plus Tesla Inc.(TSLA).

- For Tesla stock, the number of Tesla shares must equal “the last three digits of your student number” if they are larger than 400 or “the first three digits of your student number” if they are smaller than or equal to 400.

For exapme: if your student number is S350999, you would hold 999 shares of TSLA; if your student number is S350200, you would hold 350 shares of TSLA in your portfolio. - Determine the weights and shares for the rest of the stocks you chose in step a.

- You have USD 1 million for this Portfolio.

4. Take screenshots of your portfolio and the necessary information in all sections. Make sure you attach them in the Appendixof your submitted report.

5. Suppose this is a Buy-and-Hold strategy, therefore, do not change your portfolio setting during your holding period Monday, 12 May 2025 to Friday, 23 May 2025.

Are You Looking for Answer of BAFI1026 Assessment 3 – Report

Order Non Plagiarized Assignment

BAFI1026 Questions and Marking Guide: Your report must include the following sections:

1. Trading philosophy: (2 marks)

Give an overview of your philosophy to form the portfolio. You should identify yourself as a value or growth investor or a mixture of both. Provide brief definitions for value/growth investing.

2. Portfolio construction: (5 marks)

Present your initial portfolio, including information on why you have invested in the stocks in your initial portfolio (three stock selection for Portfolio).

- The overall market and macroeconomic condition (2.5 marks)

- Industry consideration and/or diversification, specific stock’s strengths/positive prospects (2.5 marks)

3. Risk identification: (20 marks)

In this part, you should discuss the risk profile of your portfolio. On Monday, 12 May 2025, calculate the VaR of your Portfolio using 2-year daily historical stock price between 11 May 2023(exclusive) and 12 May 2025 (exclusive). The discussion should include the following points and show key steps of workings:

5. Hedging costs with Swaps: (10 marks)

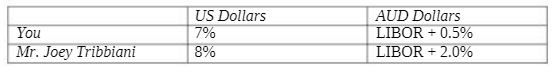

As an Australian-based investor, you want to borrow 1 million U.S. dollars at a fixed interest rate to match your investment cash flows. To achieve this, you enter into a two-year currency swap agreement with Mr. Joey Tribbiani, who wishes to borrow Australian dollars at a floating interest rate. The amounts required by both parties are roughly the same at the current exchange rate. You and Mr. Joey Tribbiani have been quoted the following interest rates, which have been adjusted for the impact of taxes:

Design a swap that will net a bank (Bank A), acting as an intermediary, 20 basis points per annum. Unlike a swap equally attractive to both parties, this task requires you to design a swap that allocates 40% of the advantage (i.e., gain) to you and 60% of the advantage (i.e., gain) to Mr. Joey Tribbiani. Determine the rates of interest that you and Mr. Joey Tribbiani will end up paying. Provide an explanation, list your calculation process, and use a diagram to illustrate the swap structure.

6. The professionalism of the report.

(e.g., Usage of professional Figures and Tables, with numbering and captions.)

Note:

- To complete the tasks 1-4, you are required to use/download relevant historical stock price data. For tasks 5 (Hedging using swap), please use the information given only. No additional data is needed.

- The working steps and discussion/summary of key results of your calculations should be discussed in the report. Besides, you also need to submit a separate Excel file to Canvas to show your detailed calculations.

- This instruction includes suggestions on items to include in the report, more information for parts you think are important may be included as you feel necessary, keeping in mind the word limit.

- The teaching team is not supposed to comment on your calculation workings or identify your calculation mistakes. The teaching team will provide guidance to make sure that you are on the right track. However, it is still your responsibility to investigate your work and identify the errors